The assets that a bank holds on its balance sheet (statement of financial position). Banks assets consist of loans extended to customers, marketable securities and of reserves of base money (cash and deposits of cash/ credit/ balances with the central bank), investments, tangible assets (real estate holdings, equipment, etc.), and intangible assets (goodwill and similar forms of assets), as well as any prepaid items.

Bank assets refer to the items owned by a bank that help it operate and offer its services to the customer base. Bank assets are usually concentrated in money-related assets (monetary assets) and the broader category of financial assets (that mainly include loans and financial securities).

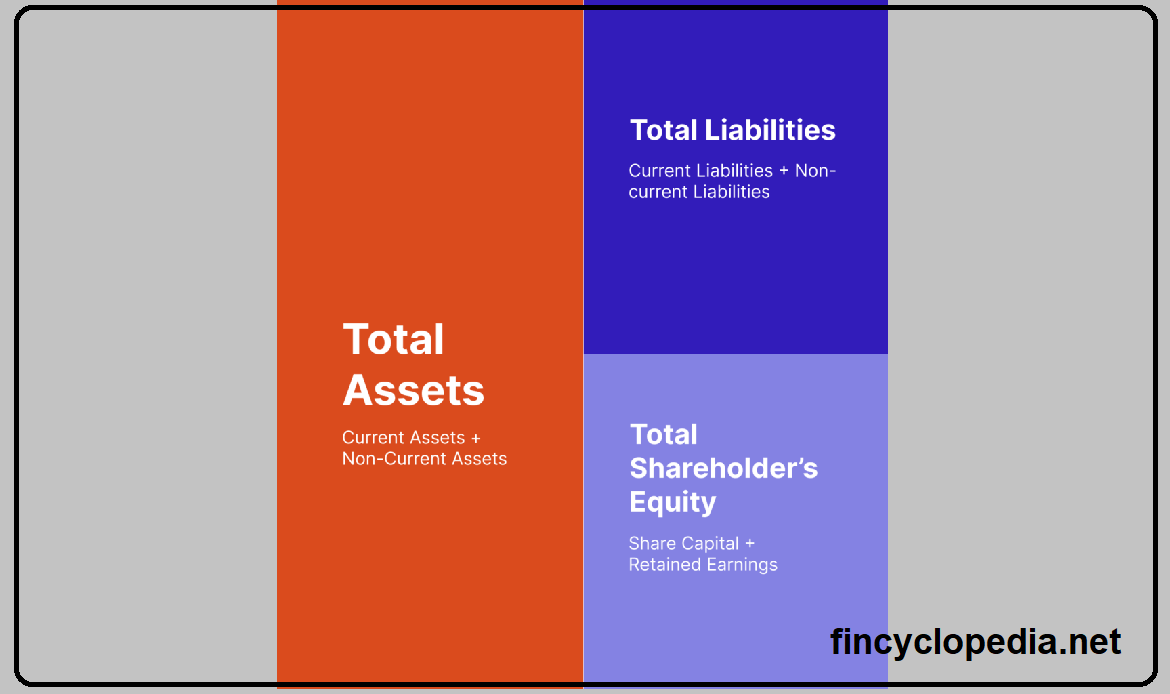

The difference between a bank’s assets and its liabilities, is capital (equity) representing the net worth of the bank or its equity as a going concern.