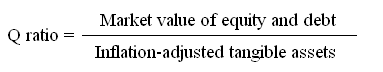

The ratio of stock price (i.e., market value of a company) to the current replacement value of a company’s tangible assets such as property, plant, inventory, equipment, cash, and investment in securities:

The degree to which a company’s reported earnings during a given period faithfully reflect income for that period. In accounting terms, reported earnings should be a fair representation of a company’s performance for the reporting period and should also provide relevant information to forecast expected future earnings. Companies applying conservative accounting policies tend to underestimate current earnings and thus have high earnings quality. Indicators or high earnings quality are: 1) conservative management, 2) expanding research and development budget faster than revenues, and 3) cash flow growing along with net income and increasing in gross margin. On the other hand, low earnings quality can be inferred from: 1) increases in receivables, 2) capitalization of interest, 3) high frequency or size of one-time items, and 4) earnings growing due to decreased tax rate, rather than from organic factors.

Comments