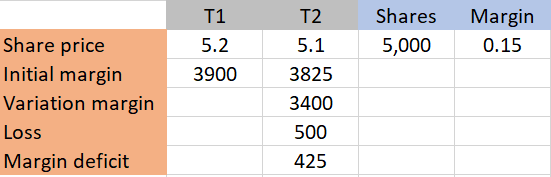

In connection with margin trading, it is the amount by which the balance of a margin account falls below the initial margin. If the account holder cannot maintain the margin requirement, he/ she will not be able to retain the position, though he /she can still reduce or close the position altogether. For example, an investor purchased 5,000 shares at $5.2 per share (total value = $26,000), using a margin account (margin is 15%, or $3,900). This means the investor had to deposit $$3,900 in the margin account to open the position (time 1). Later on (time 2), the share price dropped to $5.1, leaving the deposited margin at a lower level: $3,825 (initial margin at time 2). The price difference (5.2-5-1 * 5,000 = 500) is the paper loss. Deducting the paper loss from the initial margin at time 1 will produce the so-called variation margin:

Variation margin = 3,900 – 500 = 3,400

Now, the margin deficiency (or deficit) can be calculated using the following formula:

Margin deficit = initial margin at time 2 – variation margin

Margin deficit = 3,825 – 3,400 = 425

The investor would have to cover this deficit by topping up the account.

The following table summarizes margin deficit calculations:

The margin deficiency is also known as a margin shortage.

Comments