By definition, a deposit is cash amounts, checks or drafts given or endorsed to a bank (depositee) and credited to the account of the customer (depositor). Therefore, deposits represent the funds provided by customers and held on deposit at a bank.

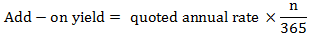

Eurocurrency deposits, certificates of deposit, and domestic interbank deposits are typically traded on a yield basis. The yield on bank deposits is known as an add-on yield because the principal amount to be deposited is paid in full at inception and is repaid at maturity with interest added on. The rates for such deposits are quoted on a simple interest basis.

For example, consider a 90-day sterling CD rate that is quoted at 8% per annum. The holding period return over the life of the certificate of deposit (CD), i.e., 90 days, is the add-on yield:

Add-on yield = 0.08 × (90/365) = 0.01972 = 1.972%

Comments