It stands for equity-linked note; a structured equity derivative product that capitalizes on the performances of a fixed-income instrument and some underlying equity. This note is a standard fixed-income instrument whose coupon is effectively a pass-through of a specific underlying equity dividend. Its redemption value is directly linked to the price performance of that equity. The issuer may hedge its exposure by simultaneously entering into an equity swap in which it receives the total return on the equity, thereby covering the note liability, in exchange for paying a floating rate rate (e.g., LIBOR). There are more sophisticated types of equity-linked notes including SUPER, SHIELDS, synthetic PERCS, SUN, etc.

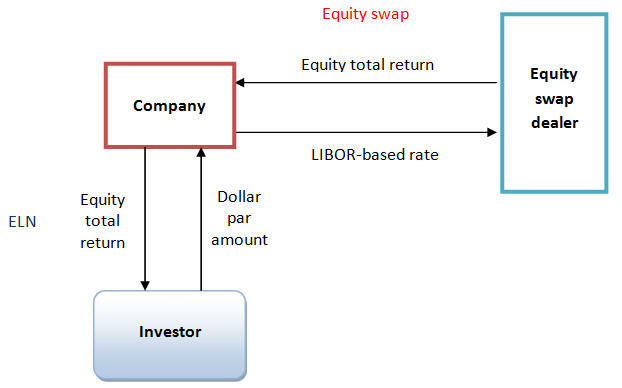

An equity-linked note (ELN) has the following structure:

The above diagram shows an ELN hedged with an equity swap; the company hedges its exposure by simultaneously entering into an equity swap with a dealer, in which it receives the total return on the equity (thereby covering its note liability), and pays a floating rate. The investor with which the ELN is usually negotiated could be a bank, insurance firm, etc.