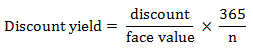

The discount on a money market instrument (such as Treasury bills, commercial paper, banker’s acceptances, etc) that is expressed as a percentage of par value (face value), as the following formula shows:

Where n is the number of days to maturity.

For example, if a Treasury bill with 90 days to maturity is trading at 98 (i.e., at a discount of 2% from par), the discount yield would be:

Discount yield = (2/100) × (365/90) = 8.11%

This yield is not the yield an investor receives for holding the instrument. The actual yield on a money market instrument is known as an add-on yield. It is calculated by relating the discount amount to the actual purchase price rather than face value.

According to the market practice, the discount yield is quoted on a simple interest basis rather than an annualized compound basis.