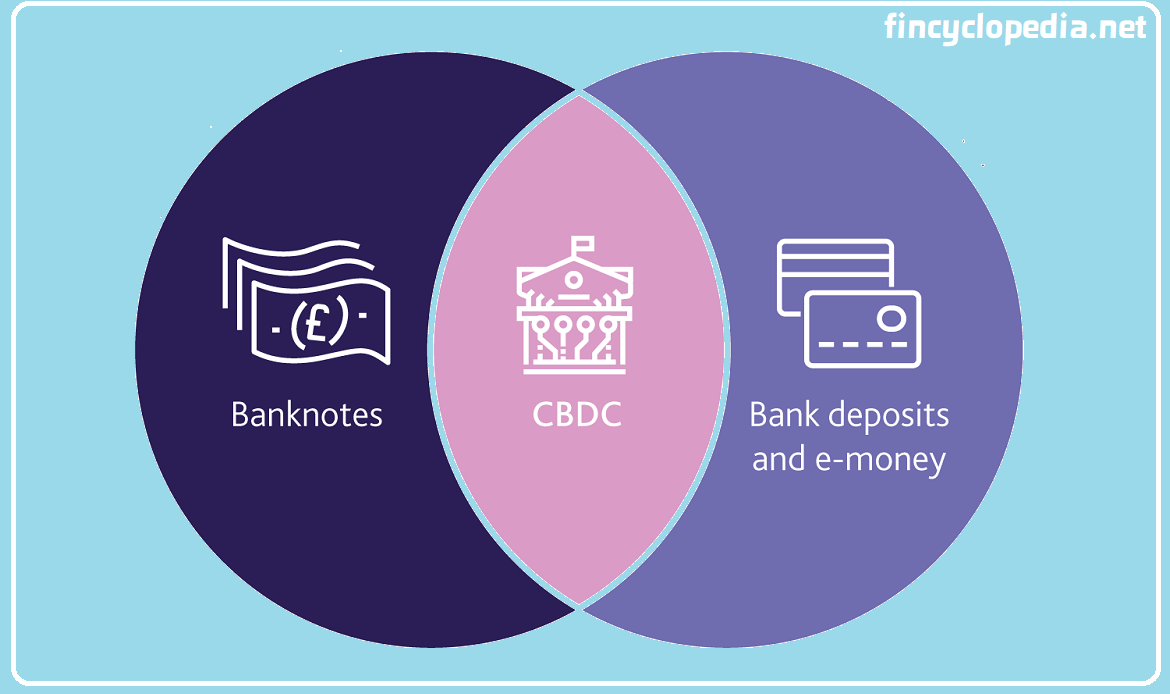

It stands for central bank money; the liabilities of a central bank that constitute banknotes (and other forms of money- overall, cash) and bank deposits (reserves) held at a central bank that can be used for settlement purposes. Banknotes represent the money (fiat money) issued by a central bank to the public as part of the money supply in an economy.

The most common types of money in an economy are central bank money (CBM, CEBM) and commercial bank money (CoBM).

The general public may also hold balances at the central bank. Such balances, including electronically tokenized balances, are called retail central bank digital currencies (CBDC).

By nature, reserve deposits are digital currency, which is available in digital form, contrary to physical money or visible cash. Cash is used mainly by the general public (thus called “retail central bank money”), is always available and accessible, and is in circulation throughout an economy where the legal tender status takes hold.

On the other hand, reserve deposits are available only to designated financial institutions, specifically commercial banks (hence, these reserves are known as “wholesale central bank money”). Wholesale central bank money is not necessarily available around the day and throughout the year, as a central bank’s computer network system determines such a possibility.