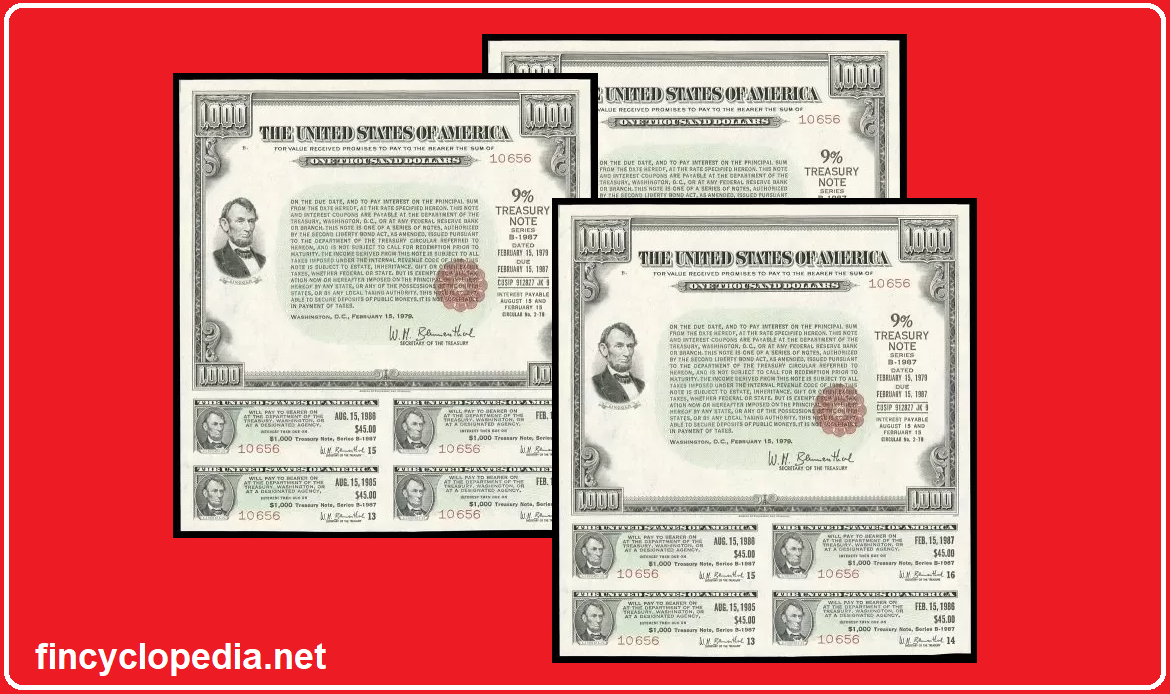

The amount that indicates the worth of an instrument, security, investment, account, etc. For example, the face value of a bond is the amount that will be paid to a bondholder at the maturity date of the bond, unless the bond issuer doesn’t default (see also: bond par value). In other words, it is typically the bond’s price at the time of issuance. Thereafter, the bond’s price changes, diverting from its face value in reaction to changes in interest rates. For a check/ cheque, face value is the amount for which it is written (the monetary amount that appears on the instrument).

Generally speaking, face value is the nominal or monetary value of a security, as determined and stated by its issuer. For stocks, its is the original value of the stock that appears on the certificate.

Face value is also known as a par value or a nominal value.