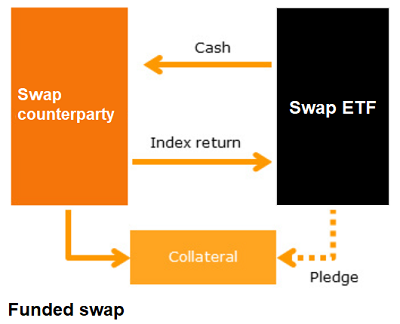

A swap exchange traded fund (swap ETF) in which the underlying swap is of the specific type of funded swaps. Distinction between funded and unfunded swaps depends on how the collateral is held. In the case of a funded swap, the swap counterparty collects collateral (from the investor) and deposits it with an independent trustee. The trustee is entrusted with holding the collateral on behalf of the fund.

In a swap ETF, certain measures can be followed to reduce or mitigate the counterparty risk, such as applying a maximum percentage on a counterparty’s holdings of the fund’s assets. Additionally, other measures can be taken such as daily swap reset, overcollateralization or the involvement of more than a swap counterparty.

Comments