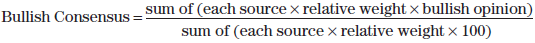

A market sentiment indicator that is used to track the trading recommendation of market professionals and analysts (i.e., the opinion of the broader market). Based on these recommendations (from different sources), this tool calculates the bullishness percentage (e.g., 60% of the opinions are bullish, and so the remaining 40% are bearish). Each source is given a relative weight, summing up all the weighted sources. The following formula is typically used for calculating the bullish consensus:

Bullish consensus values range from 0 to 100%. Markets are said to be oversold for values lower than 20% (in which case an uptrend is imminent), and overbought for values over 90% (thus a downtrend is imminent). Markets are neutral at 55% because of the bullish bias in the market (historically, it has resulted in a 5% rise over the long term).

This tool was introduced by Earl Hadady (Market Vane) in 1964.