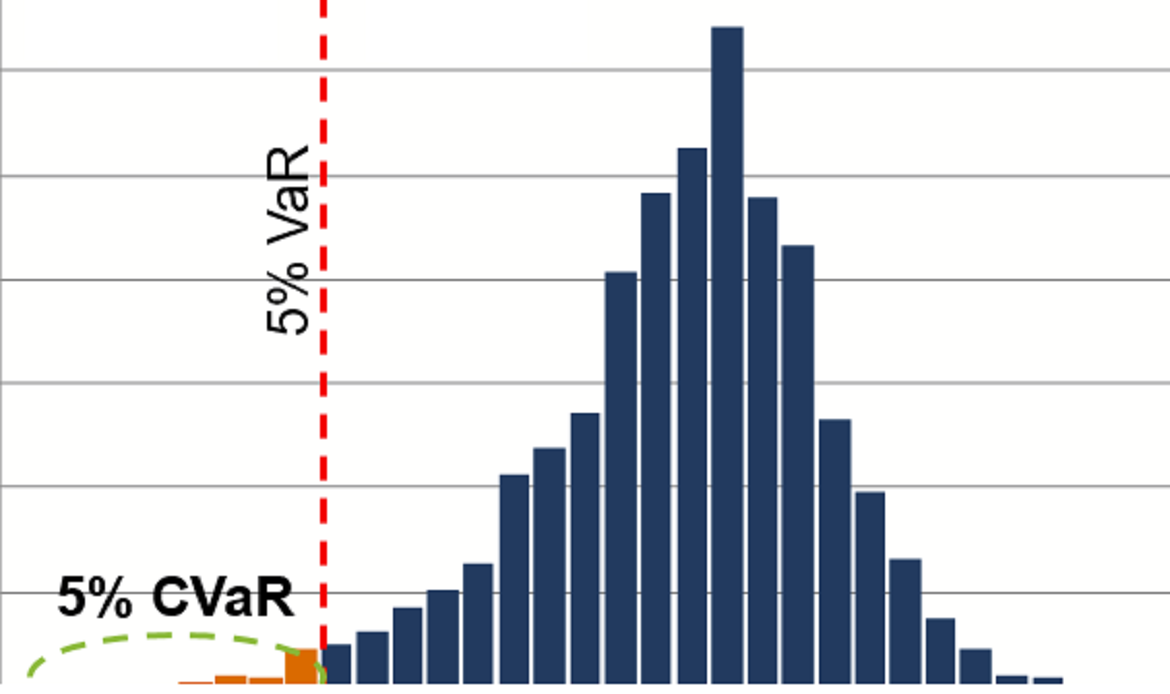

It stands for modified value at risk (modified VaR); a measure of value at risk (VaR) that is modified or expanded to correct for skewness and flat tails in a portfolio’s returns. In other words, modified VaR adjusts the normal measure of value at risk to account for non-normally distributed returns of specific asset classes (e.g., private equity, hedge funds or technology stocks, emerging market stocks, etc.)

To that end, it takes the higher moments of the return distribution into account by extending the percentile of the standard normal distribution (using Cornish-Fisher extension). A portfolio can be optimized by minimizing the modified value-at-risk at a given confidence level. Contrary to the normal value at risk, for a financial asset has negative skewness and/ or a positive excess kurtosis, the modified VaR will be larger. Furthermore, the risk measured only using volatility will be lower than the risk measured using skewness, volatility and kurtosis.

MVaR may also denote market value at risk (market VaR); a risk measure that captures the market risk of an investment/ a position/ a portfolio in a single value. Market VaR is a based on a probability of loss and a defined time horizon in which such loss can be expected to arise. In short, it represents unexpected loses at adverse move by the market.

MVaR may also stand for marginal value at risk (marginal VaR); it constitutes the amount of additional risk that is added by a new investment or asset class or position in the portfolio. This measure captures the change in a portfolio that results from addition or subtraction of a particular component.

MVaR is an acronym for other types of value at risk (VaR) including: multidimensional value at risk (multidimensional VaR), multivariate value-at-risk (multivariate VaR), and mean value at risk (mean VaR).