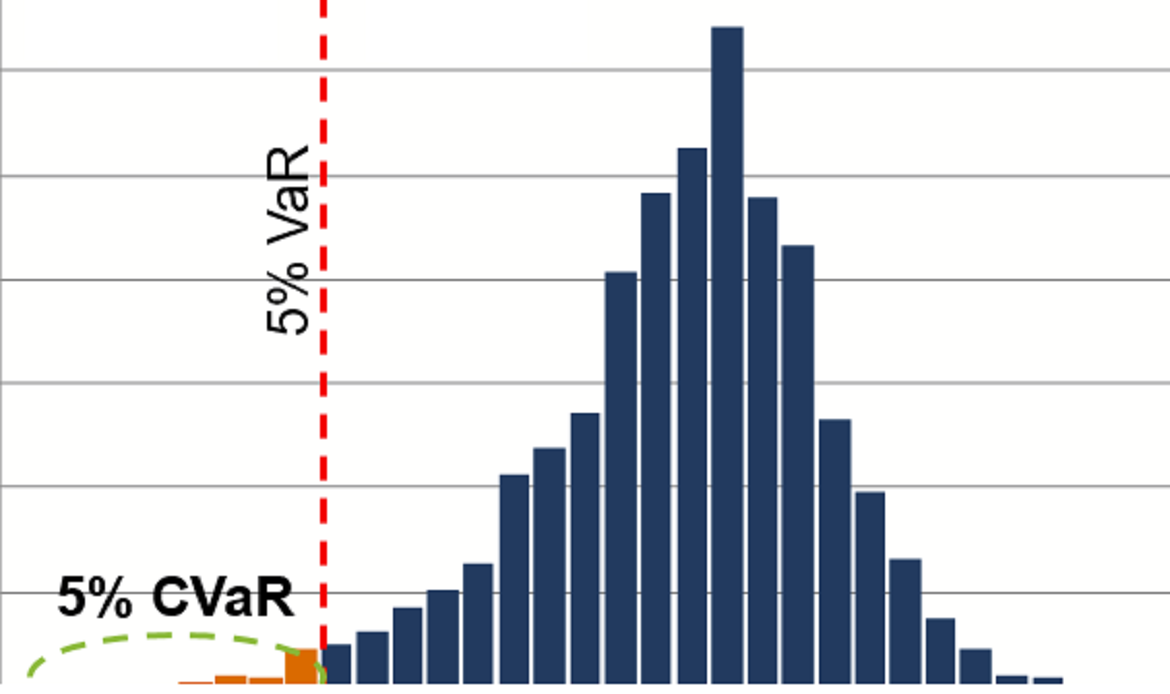

It stands for multivariate conditional value at risk (multivariate conditional VaR); A conditional value at risk (conditional VaR) that has more than a single random variable. It deals with several variables, and the relationship between the risk factors involved is taken into consideration while calculating the risk measure. This measure considers individual risks of a portfolio/ a fund and its aggregate risk, assigning more priority to the aggregate risk.

To that end, it attempts to minimize the expectation of a multivariate loss function, which balances the shortfall and surplus risks of the aggregate risk and the individual risks as part of the aggregate risk of a portfolio.