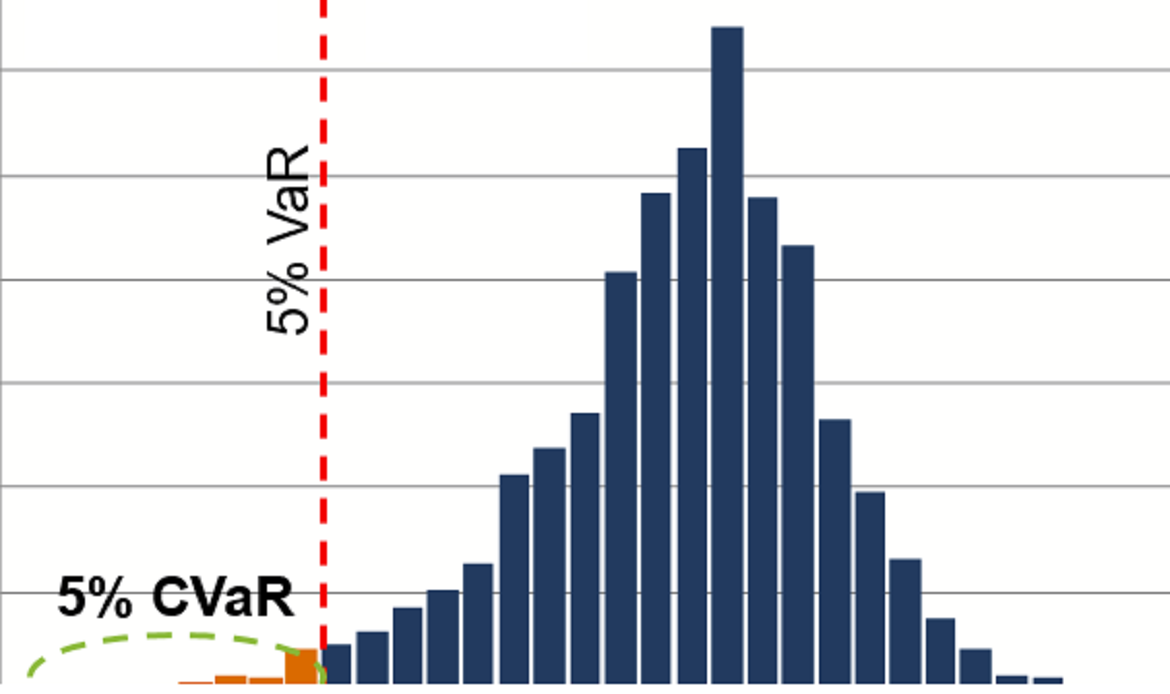

It stands for minimum conditional value at risk (minimum conditional VaR); a method of calculating conditional value at risk (conditional VaR) that aims to minimize risk (as measured by conditional value at risk) in a portfolio (a dynamic portfolio with an asset allocation algorithm) while also maximizing total return.

For that purpose, the portfolio is constructed using instruments such as exchange-traded funds (ETFs), applying a dynamic asset allocation algorithm to minimize the conditional value at risk (CVaR) while also maximizing total return.

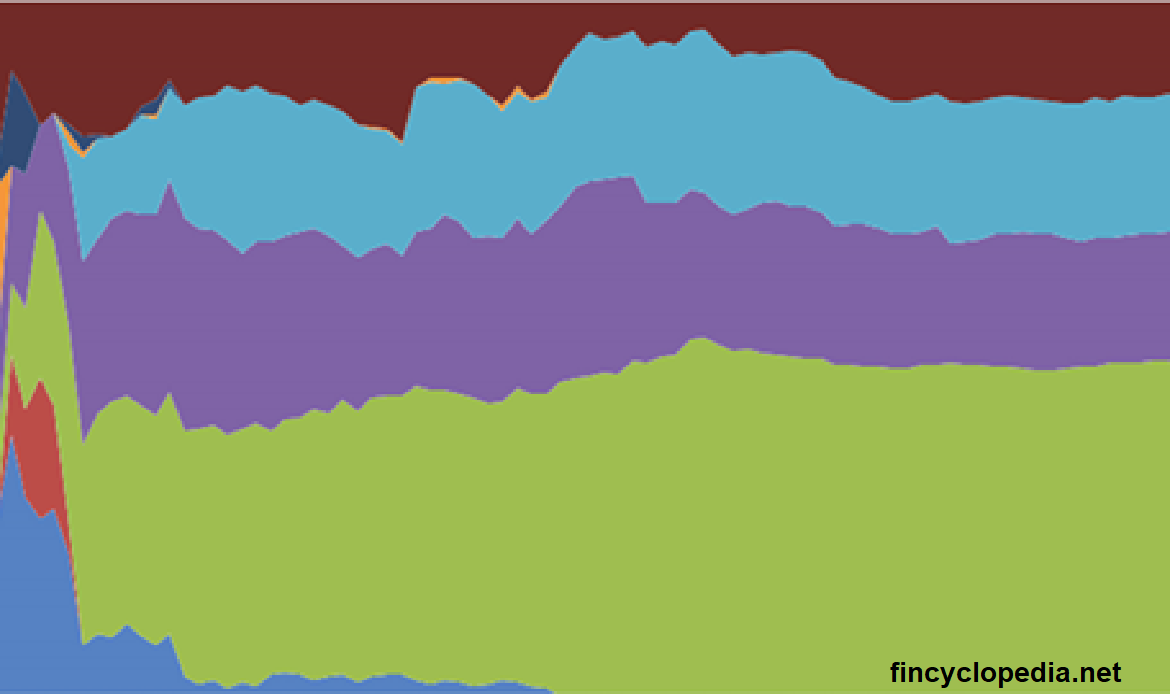

The portfolio recipe is created using an algorithm that selects the components and weightings for each of the asset class (including ETFs). It uses a tactical (dynamic or active) asset allocation approach. Selection is carried out from major asset classes.