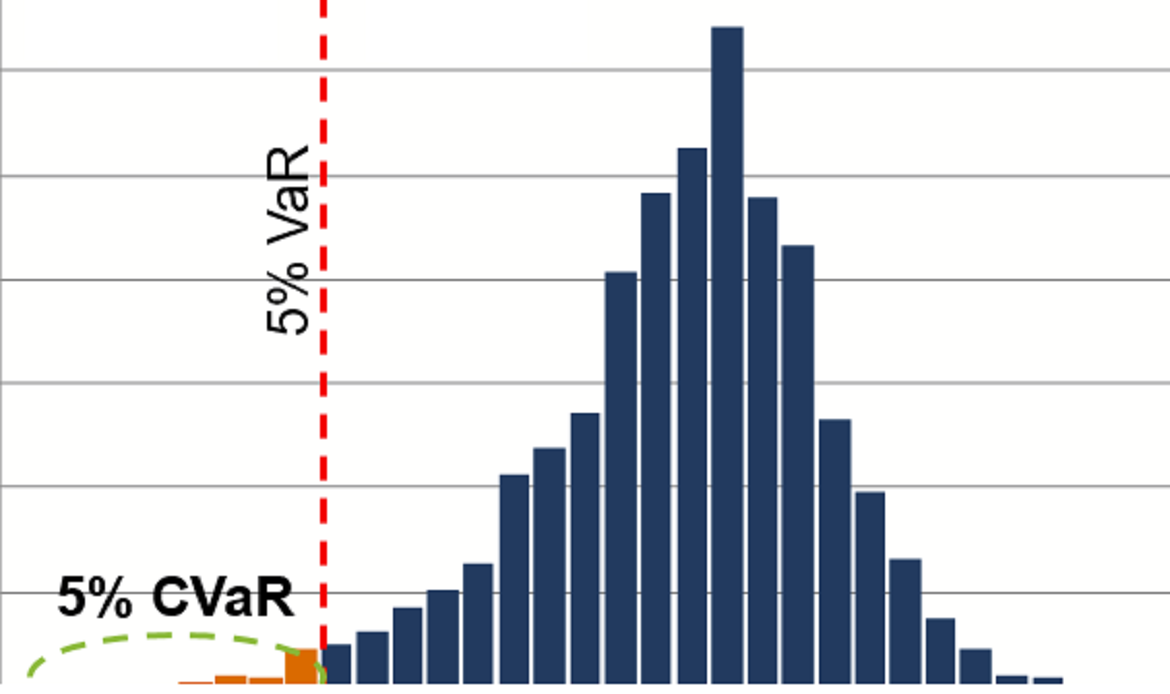

All types of risk that impact the value of market positions due to changes in market parameters/ variables including interest rates, volatility, exchange rates, etc. For a bank, such risks correspond to its trading activity, in particular, and in addition to the earlier risks: equity price risk and commodity risk.

Market price risks are managed using derivative and non-derivative instruments, in order to address the negative effect of such risks on assets, liabilities or expected future cash flows.

For the purpose of mitigating market price risks, a market participant can establish a position in derivative financial instruments such as OTC swaps, options, futures and forwards.