Concept

An initial decentralized exchange offering (IDO) is a type of crypto/ blockchain offering whereby a crypto (or digital asset) issuer can raise money and bootstrap the crypto project. An initial decentralized exchange offering (also, an initial DEX offering) is the launching of a cryptocurrency (or broadly, any type of cryptoassets) on a decentralized exchange (DEX) by blockchain projects for the purpose of selling such assets to the public. This type of offering appeared after, as an advanced alternative to, initial coin offerings (ICOs) and initial exchange offerings (IEO) and provides the potential to serve multiple functions or ends beyond its initially intended purpose. After cryptoassets (e.g., coins and tokens) are listed after completion of the fundraising event, an IDO entails immediate listing on the DEX.

Crypto public offerings

In many aspects, an ICO (initial coin offering) is the cryptocurrency equivalent of an initial public offering (IPO) that is commonplace in the securities market. However, as opposed to IPOs, ICOs are not regulated and as such pose a great deal of risk. Coins issued in an ICO also can carry a certain type of value, other than being a medium of exchange, such as utility for a software service or product. In certain countries, ICOs are unregulated, and issuers and investors are left for their own, having to apply their own measures and due diligence. However, if an ICO meets the classification of a securities offering in a certain jurisdiction, issuance will be in the ambit of a securities and exchange commission’s jurisdiction and is regulated by respective securities laws.

An IEO is an event at which cryptocurrency projects and start-ups list their offerings through an exchange in order to raise capital from contributors. It represents a form of blockchain crowdfunding where a crypto exchange provides blockchain projects and startups with a platform to issue their coins and tokens and raise funds from investors. An IEO provides an additional layers of protection for investors embodied in the verification process that crypto exchanges carry out. While in IEO, the exchange platform is fully in charge of the project and token display, the project, in an initial decentralized exchange offering, is presented on a third party exchange platform and a side-by-side token is listed on a DEX platform. Therefore, investors can open a pool leading to hard capitalization resulting in immediate liquidity, fast trading and open and fair fundraising.

Initial decentralized exchange offering as a new platform

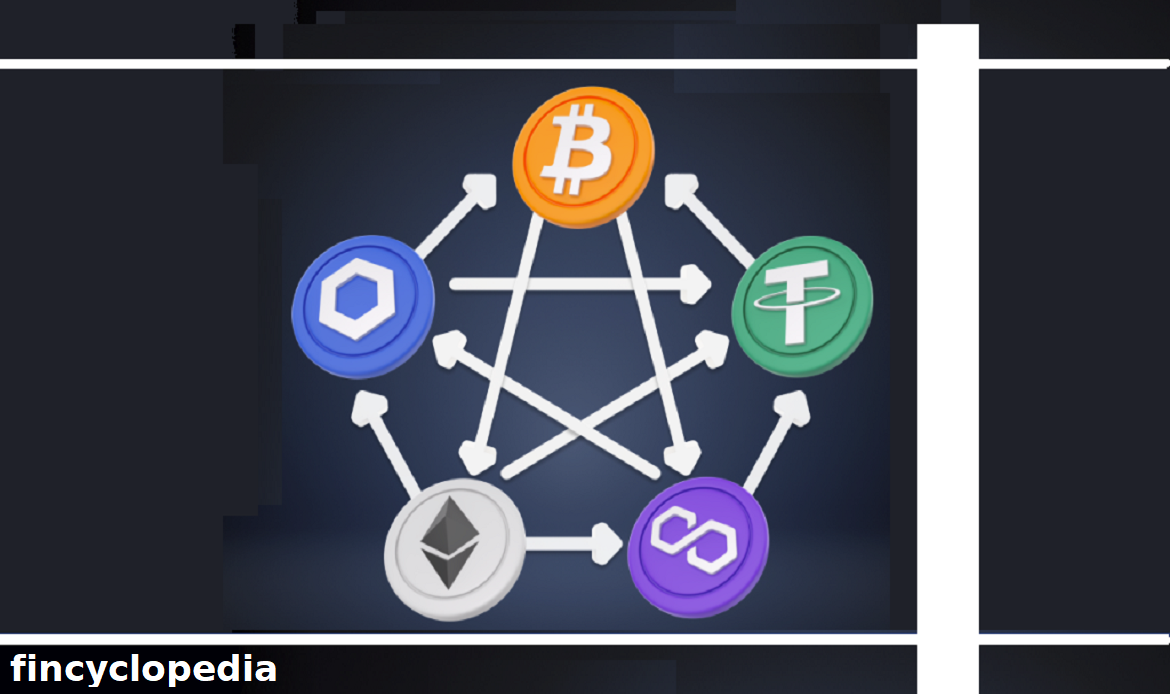

An initial DEX offering, or initial decentralized exchange offering, is a new type of decentralized and permissionless crowdfunding platform, with a great potential as a new method of fundraising in the crypto space, by capitalizing on the power of decentralized exchange. A project launches its own initial DEX offering (IDO) as a platform for issuing and floating a coin or token via a decentralized liquidity exchange. The cryptoasset exchange depends, in its work, on liquidity pools where market participants can trade coins and tokens, such as crypto coins and stablecoins without a central authority. As of the time of writing, initial decentralized exchange offerings account for over 85 percent of the market activity.

IEO and initial decentralized exchange offering were introduced for the first time in 2017 and 2019, respectively. While IEOs gained momentum as an alternative to ICOs in 2018, initial decentralized exchange offering activity remained limited at the time, but substantially increased in late 2020, whereas ICO activity remained largely low, notwithstanding the bullish markets. IEOs and initial decentralized exchange offerings share the same fundamentals with ICOs, but with a fundamental difference: the asset sale is administered by a centralized cryptocurrency exchange (in IEOs) or decentralized launchpad (in initial decentralized exchange offerings) rather than by issuers themselves.