The theoretical value of a warrant consists of two components: intrinsic value (formula value) and time value:

Warrant value = formula value + time value

The formula value is the difference between the underlying share price and the warrant’s exercise price, multiplied by the number of new shares issued on exercise. This value is either positive or zero, but can’t be negative. On the other hand, the time value is the premium over formula value (this premium is known as the price). The time value is always positive and approaches zero with the passage of time (up until the expiration date).

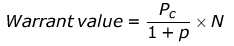

The value of a warrant, also known as the fair price of a warrant, is also given by:

Where: Pc is the value of an American call option with the same exercise price and expiration date as the warrant, p is the proportionate increase in the number of shares outstanding if all the warrants were exercised, and N is the number of new shares issued if warrant is exercised.