It stands for net present value; the current value of a series of future payments and receipts that is calculated applying a specific discount rate (usually the required rate of return), reflecting the time value of money (MVM) of all relevant cash flows as measured at the present time. It is a technique for calculating the return on investment, or ROI, for an investment, a project or expenditure.

The calculation reflects the notional that “money today is worth more than money tomorrow” (i.e., the worth of a dollar today is more than its worth in the future). And future amount or a series of amount is discounted by the interest rate applied (the discount rate).

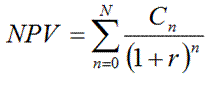

The formula of NPV is given by:

Where: C denotes the cash flows arising at the end of each period, N is the investment term denoting the number of all periods, n is a respective period within the entire investment term, and r is the discount rate for a specific period or for the term.