A short call synthetic straddle is a neutral option strategy (in essence, it is a short straddle strategy) that is based on two legs involving selling two at-the-money calls for every 100 shares bought.

| Short Call Synthetic Straddle |

| Sell 2 ATM calls Buy 100 shares |

Risk/Return Profile

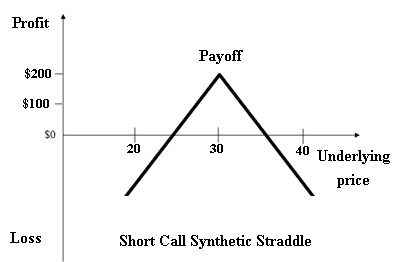

The risk profile of a short call synthetic straddle replicates that of a short straddle. This strategy represents a bet on low volatility. Short call synthetic straddles are limited profit, unlimited risk positions that are created when the investor expects that the underlying price would be much less volatile in the near future.

Limited profit: an investor can make highest profit from this position when the underlying price at expiration is trading at the exercise price of the short options. At this point, the two short options would expire worthless, while the investor keeps for himself the whole amount of the net premium received from selling the two options.

- Maximum profit = net premium received – commissions paid

- Maximum profit: when underlying price = exercise price of short call

Unlimited risk: the investor would sustain huge losses for this position when the underlying price is trading at expiration at a level way too far from the exercise price. A big upward move means the short call would expire deep in the money, while a big move in the opposite direction would result in huge losses on the long stock position.

- Maximum loss = unlimited.

- Loss results when: underlying price > (exercise price of short call + net premium received).

- In this case: loss = underlying price – (exercise price of short call + net premium received)

- Also, loss results when: underlying price < (underlying price paid – net premium received).

- In this case: underlying price paid – (underlying price + net premium received – commissions paid)

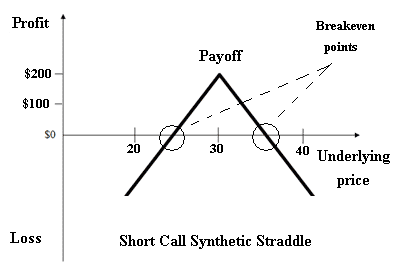

Breakeven Points

A short call synthetic straddle has two breakeven points:

- Upper breakeven point= exercise price of short call + net premium received

- Lower breakeven point= underlying price paid – net premium received

Theoretical Example

If the stock of a given company is currently at $50 (say, in April). An investor may construct a short call synthetic straddle by selling two June calls for $250 each and buying 100 shares for $5,000 (of course, on the expectation that the stock will not divert in any direction from its current level). Therefore, the investor receives from selling the calls a net premium of $250 × 2= $500. If the stock price moved up to $60 by expiration date in June. The two calls would be exercised against the investor (both are in the money); the intrinsic value of each call is thus 100 × 10 = $1000. On the other hand, the long position in the underlying stock would produce a profit of $1,000. It follows that the investor’s loss is:

Loss = $2,000 – $1,000 – $500= $500

If, on the contrary, the stock remains at its initial level ($50), the two calls will not be exercised, while the long stock position neither produces a profit nor results in a loss. In this case, the investor is said to have made the maximum profit amount represented by the net premium received from the two short options, i.e., $500.