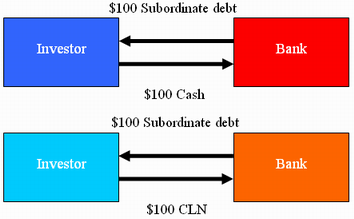

A self-referenced credit derivative (a credit-linked note– CLN for short) which involves a firm (or an investor) selling protection on itself by buying a security (or taking a long position in an instrument) that is embedded with a credit default swap (CDS), where the firm (or the investor) assumes the roles of both the protection seller and the reference entity. This structure is characteristically perfectly correlated to the creditworthiness of the protection seller (as it acts also the reference entity). Self-referenced CLNs may be transacted between an investor who issues the CLN and a bank which buys it. The CLN is linked to a credit event the reference of which being the bank itself. The following diagram illustrates the structure of a self-referenced CLN:

Upon a credit event, the CLN would be written down to zero while the CLN buyer would lose the entire amount invested therein. After default, the investor would be left with a valueless asset, while its liability, the CLN, would be entirely wiped out, resulting in a breakeven position or a tiny amount of profit. Conventionally, companies enter into self-referenced credit derivative transactions for various considerations including regulatory arbitrage. Self-referenced CLNs are usually sought for their higher returns relative to similar products. They could particularly viable in case a company is thinly traded in the single-name CDS market and demand for protection is higher than supply.