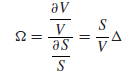

A measure of gearing which is calculated by multiplying the gearing of a call option (put option) by the call option’s (put option’s) delta. It measures the percentage change in the option price relative to that in its underlying asset. Symbolically, omega is given by:

Where: Ω is omega (effective gearing), V is the option price, S is the underlying price, is Δ delta, and S/V is simple gearing.

It is also referred to as elasticity.

In another context, omega is also a tool that measures the currency risk associated with the purchase or sale of a currency option when the value of the option would need to translate into another currency.

Also, omega refers, sometimes, to the third “mathematical derivative” of the option price with respect to the price of its underlying.