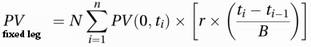

A swap valuation method which is used to price a vanilla interest rate swap. The value of the fixed leg can be calculated using the following formula:

Where:

N is the notional principal amount

n is the number of payments over the swap term

T is the maturity date of the swap

r is the swap rate (the fixed rate)

ti is the payment date, where i= 1, 2, 3, …., n

B is the money market day count, whilst ti – ti-1 is actual number of days between two respective payment dates

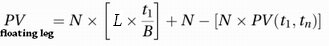

The value of the floating leg can also be calculated using the following equation:

Where:

L is the LIBOR rate for the next payment period.

The swap value is simply the present value of its fixed rate leg minus the present value of its floating rate leg.