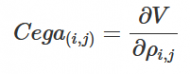

The first-order sensitivity (delta) of the price of a multi-asset option to a move in the correlation(s) between two underlyings or more. For a two-asset option, the correlation delta (cega) that involves assets Si and Sj is calculated as follows:

Where: δV is the change in the option’s price that corresponds to the change in the correlation between the two underlying prices δρi,j

As a matter of fact, correlations vary with the passage of time, and consequently, a multi-asset option’s sensitivity to the correlation between a pair of underlying assets can vary over time.

Specific types of multi-asset derivatives have complex correlations, which would necessitate considering second-order sensitivities and the potential effect on the price that may arise from a movement in the correlation(s).