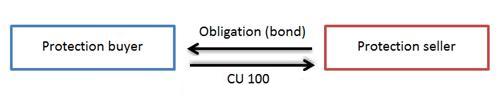

In the context of credit default swaps (CDS) and similar credit derivatives, settlement takes place once a credit event (bankruptcy, restructuring, failure to pay, etc.) has been triggered. The settlement between the protection buyer and seller could either be cash or physical. Physical settlement involves the transfer of the underlying obligation (e.g. a government or corporate bond or any other deliverable obligation) from the protection buyer to the protection seller. In return, the protection buyer receives the full face value.

Where: CU denotes currency unit.