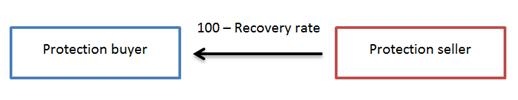

In the context of credit default swaps (CDS) and similar credit derivatives, settlement takes place once a credit event (bankruptcy, restructuring, failure to pay, etc.) has been triggered. The settlement between the protection buyer and seller could either be cash or physical. With a cash settlement, the protection buyer does not have to deliver the underlying obligations (e.g. bond). The protection seller only has to pay a specific amount of cash to the protection buyer. This amount is the difference between the bond’s nominal value and the market value at the time of settlement (based on recovery rate). It is determined via an auction.