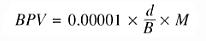

The basis point value (BPV) of a swap is the amount by which the swap’s value changes in response to a change of one basis point (BP) in the same-maturity swap rate. Differently stated, a swap BPV refers to the amount of change (increase or decrease) in the swap’s value for every basis point that the closing day’s swap rate with identical maturity trades above or below the swap fixed rate. As such, the basis point value of a swap is given by:

Where: d/B is the swap’s daycount basis (d denotes the number of days in the floating period, and B refers to the year daycount, whether 360 or 365); M is the notional principal of the swap.

However, a change in the swap’s value resulting from a change in market rates in not realized during its life (because the mark-to-market valuation produces only unrealized or paper profits and losses), but it is realized on its maturity date.