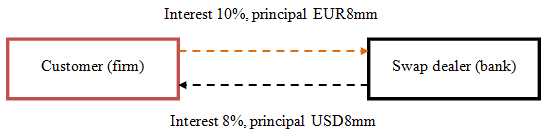

It stands for coupon-only swap; a form of cross currency swap that entails no exchange of principal in two different currencies at maturity, and only the interest payments (i.e., coupons) are exchanged. In this sense, a coupon-only swap (CoS) is like an exchange of a strip of coupons in one currency for another strip of coupons in another currency. This swap structure is typically a cost reduction strategy with a conservative risk-reward ratio. The following is a graphical illustration of a coupon only swap:

The payoff of CoS is measured as a spread adjusted with a barrier condition (suppose the exchange rate range is 1.1250-1.3550): 5% per annum if USD EUR trades in a particular range and 0% per annum if USD EUR breaks outside the preset range. The above illustration shows that the company faces a maximum interest rate risk of 2.00% if the specified range is broken. However, it will receive a maximum gain of 3.00% in the opposite case.

This swap is also known as an interest-only swap or an annuity swap.