A contract that is similar to a traditional futures contract but carries no expiration date. It is a type of derivative commonly used for trading cryptocurrencies where traders can that can take direction and speculate on the price of an underlying cryptocurrency. Without an expiration date, no physical settlement of the underlying would be expected. Only cash settlement can take place, where the sole purpose of a perpetual futures contract is to take position as to the price of the underlying asset.

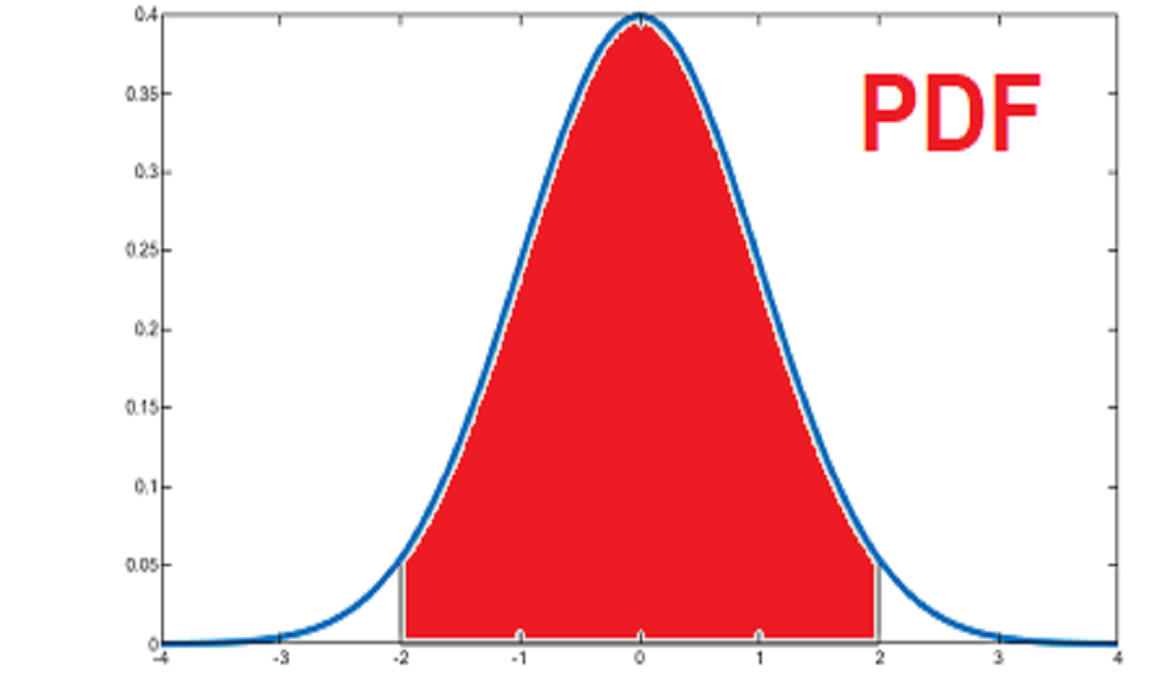

A perpetual futures contract is settled using a funding mechanism (futures funding rate) to maintain a balance between market price and underlying reference price (price tracking), often pegged to an index. This mechanism aims to curb down market manipulation while enabling fair price discovery.

Perpetual futures (or perps, for short) are leveraged products, i.e., traders can open larger positions with a fraction of the funds compared to traditional futures derivatives. Perps are also not heavily regulated, where any market participant can have access to trading. In general, perpetual futures contracts allow investors to buy and sell assets like stocks and commodities at wide ranges of future prices. They can also borrow money to increase (leverage) the size of their transactions.

By nature, futures operate under a margining mechanism, and perps, specifically, allow entering into unlimited long or short positions as long as the maintenance margin is met. The initial margin is a fraction of the total value of the position or transaction, entailing a bigger exposure with less capital. The maintenance margin is kept as a minimum balance is maintained to ensure all the positions take remain open, and a margin call may initiate if the balance in the trading account drops below this margin.

Perpetual futures contracts were conceptually introduced in 1992 as a potential means of allowing illiquid assets to be used as underlying in derivative contracts. However, market development depends on existence of sufficient interest from market participants, which never materialized then.

With the emergence of cryptocurrencies, the perpetual futures model could be utilized for cryptocurrency via the funding model. Market interest for cryptocurrency picked up over the years (starting in 2015) with the establishment of the first perpetual futures exchanges offering exposure to the BTC/USD pair back then. Perpetuals (perps) allowed the cryptocurrency futures market to significantly expand since then.

A perpetual futures contract may also be known as a perpetual swap.